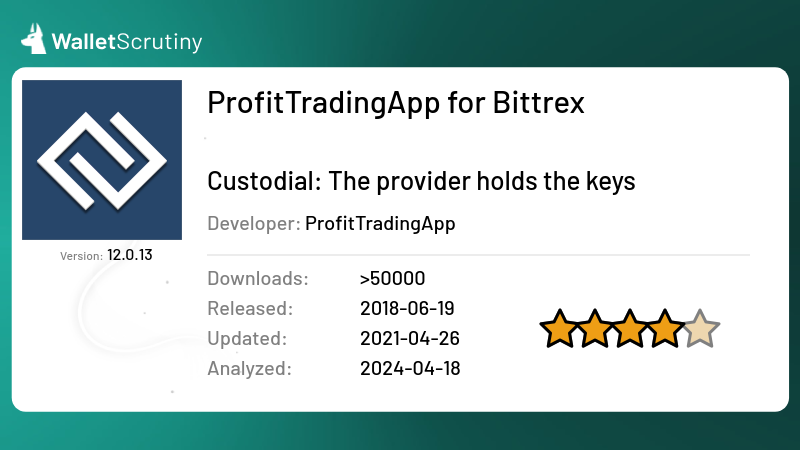

ProfitTradingApp for Bittrex

Google PlayOur wallet review process

We examine wallets starting at the code level and continue all the way up to the finished app that lives on your device. Provided below is an outline of each of these steps along with security tips for you and general test results.

Released

20th June 2018

Custody

Custodial!

But This product was removed from the platform.

As part of our Methodology, we ask: Does the product allow self-custody?

The answer is "no". Therefore we marked it as "Custodial: The provider holds the keys".

Read more

Source code

Application build

Build cannot be done because the source code is not publicly available.Distribution

Google PlayPassed 5 of 8 tests

We answered the following questions in this order:

We stopped asking questions after we encountered a failed answer.

The answer is "yes".

If the answer were "no", we would mark it as "Few users" and the following would apply:

The answer is "no". We marked it as "Few users".

We did not ask this question because we failed at a previous question.

If the answer were "no", we would mark it as "Few users" and the following would apply:

We focus on products that have the biggest impact if things go wrong and this one probably doesn’t have many users according to data publicly available.

The answer is "yes".

If the answer were "no", we would mark it as "Fake" and the following would apply:

The answer is "no". We marked it as "Fake".

We did not ask this question because we failed at a previous question.

If the answer were "no", we would mark it as "Fake" and the following would apply:

The bigger wallets often get imitated by scammers that abuse the reputation of the product by imitating its name, logo or both.

Imitating a competitor is a huge red flag and we urge you to not put any money into this product!

The answer is "yes".

If the answer were "no", we would mark it as "Not a wallet" and the following would apply:

The answer is "no". We marked it as "Not a wallet".

We did not ask this question because we failed at a previous question.

If the answer were "no", we would mark it as "Not a wallet" and the following would apply:

If it’s called “wallet” but is actually only a portfolio tracker, we don’t look any deeper, assuming it is not meant to control funds. What has no funds, can’t lose your coins. It might still leak your financial history!

If you can buy Bitcoins with this app but only into another wallet, it’s not a wallet itself.

The answer is "yes".

If the answer were "no", we would mark it as "A wallet but not for Bitcoin" and the following would apply:

The answer is "no". We marked it as "A wallet but not for Bitcoin".

We did not ask this question because we failed at a previous question.

If the answer were "no", we would mark it as "A wallet but not for Bitcoin" and the following would apply:

At this point we only look into wallets that at least also support BTC.

The answer is "yes".

If the answer were "no", we would mark it as "Can't send or receive bitcoins" and the following would apply:

The answer is "no". We marked it as "Can't send or receive bitcoins".

We did not ask this question because we failed at a previous question.

If the answer were "no", we would mark it as "Can't send or receive bitcoins" and the following would apply:

If it is for holding BTC but you can’t actually send or receive them with this product then it doesn’t function like a wallet for BTC but you might still be using it to hold your bitcoins with the intention to convert back to fiat when you “cash out”.

All products in this category are custodial and thus funds are at the mercy of the provider.

The product cannot be independently verified. If the provider puts your funds at risk on purpose or by accident, you will probably not know about the issue before people start losing money. If the provider is more criminally inclined he might have collected all the backups of all the wallets, ready to be emptied at the press of a button. The product might have a formidable track record but out of distress or change in management turns out to be evil from some point on, with nobody outside ever knowing before it is too late.

The answer is "yes".

If the answer were "no", we would mark it as "Custodial: The provider holds the keys" and the following would apply:

The answer is "no". We marked it as "Custodial: The provider holds the keys".

We did not ask this question because we failed at a previous question.

If the answer were "no", we would mark it as "Custodial: The provider holds the keys" and the following would apply:

A custodial service is a service where the funds are held by a third party like the provider. The custodial service can at any point steal all the funds of all the users at their discretion. Our investigations stop there.

Some services might claim their setup is super secure, that they don’t actually have access to the funds, or that the access is shared between multiple parties. For our evaluation of it being a wallet, these details are irrelevant. They might be a trustworthy Bitcoin bank and they might be a better fit for certain users than being your own bank but our investigation still stops there as we are only interested in wallets.

Products that claim to be non-custodial but feature custodial accounts without very clearly marking those as custodial are also considered “custodial” as a whole to avoid misguiding users that follow our assessment.

We have to acknowledge that a huge majority of Bitcoiners are currently using custodial Bitcoin banks. If you do, please:

- Do your own research if the provider is trust-worthy!

- Check if you know at least enough about them so you can sue them when you have to!

- Check if the provider is under a jurisdiction that will allow them to release your funds when you need them?

- Check if the provider is taking security measures proportional to the amount of funds secured? If they have a million users and don’t use cold storage, that hot wallet is a million times more valuable for hackers to attack. A million times more effort will be taken by hackers to infiltrate their security systems.

The answer is "yes".

If the answer were "no", we would mark it as "No source for current release found" and the following would apply:

The answer is "no". We marked it as "No source for current release found".

We did not ask this question because we failed at a previous question.

If the answer were "no", we would mark it as "No source for current release found" and the following would apply:

A wallet that claims to not give the provider the means to steal the users’ funds might actually be lying. In the spirit of “Don’t trust - verify!” you don’t want to take the provider at his word, but trust that people hunting for fame and bug bounties could actually find flaws and back-doors in the wallet so the provider doesn’t dare to put these in.

Back-doors and flaws are frequently found in closed source products but some remain hidden for years. And even in open source security software there might be catastrophic flaws undiscovered for years.

An evil wallet provider would certainly prefer not to publish the code, as hiding it makes audits orders of magnitude harder.

For your security, you thus want the code to be available for review.

If the wallet provider doesn’t share up to date code, our analysis stops there as the wallet could steal your funds at any time, and there is no protection except the provider’s word.

“Up to date” strictly means that any instance of the product being updated without the source code being updated counts as closed source. This puts the burden on the provider to always first release the source code before releasing the product’s update. This paragraph is a clarification to our rules following a little poll.

We are not concerned about the license as long as it allows us to perform our analysis. For a security audit, it is not necessary that the provider allows others to use their code for a competing wallet. You should still prefer actual open source licenses as a competing wallet won’t use the code without giving it careful scrutiny.

The product cannot be independently verified. If the provider puts your funds at risk on purpose or by accident, you will probably not know about the issue before people start losing money. If the provider is more criminally inclined he might have collected all the backups of all the wallets, ready to be emptied at the press of a button. The product might have a formidable track record but out of distress or change in management turns out to be evil from some point on, with nobody outside ever knowing before it is too late.Application information

2021-09-17 Update:

The provider ProfitTradingApp features a list of apps:

ProfitTradingApp For Binance

ProfitTradingApp For Binance

ProfitTradingApp For KuCoin

ProfitTradingApp For KuCoin

ProfitTradingApp for FTX

ProfitTradingApp for FTX

ProfitTradingApp for OKEx

ProfitTradingApp for OKEx

ProfitTradingApp For Bybit

ProfitTradingApp For Bybit

ProfitTradingApp for BinanceUS

ProfitTradingApp for BinanceUS

ProfitTradingApp for BitMEX

ProfitTradingApp for BitMEX

ProfitTradingApp for Huobi

ProfitTradingApp for Huobi

ProfitTradingApp for HitBTC

ProfitTradingApp for HitBTC

ProfitTradingApp for Coinbase

ProfitTradingApp for Coinbase

ProfitTradingApp for Kraken

ProfitTradingApp for Kraken

each of which act as an interface to the respectively mentioned exchange.

While the provider doesn’t custody your coins, neither do you. This app can trade on your behalf via its bots and you can also withdraw and deposit. This means you can use it as a wallet but not only are your coins in custody of the respective exchange, this app probably can also empty all the accounts of all its users at once which is why we consider it itself custodial and thus not verifiable.

Previous Review 2021-09-17

Bittrex has its own app. It makes one wonder why it’s necessary to use this one. Additionally, upon installing the app you are required to register with ProfitTrading and secondly, with Bittrex.

ProfitTrading’s app does not have a wallet per se, but rather links to Bittrex, by asking users to provide the Bittrex API.

From the Terms & Conditions:

- LINK TO THIRD PARTIES: The App may contain links to websites operated by third parties (“Third Party Websites”). ProfitTrading APP may monetise some of these links through the use of third party affiliate programmes. Notwithstanding such affiliate programmes, ProfitTrading APP does not have any influence or control over any such Third Party Websites and, unless otherwise stated, is not responsible for and does not endorse any Third Party Websites or their availability or contents.

An affiliate program by definition “endorses” a third party. We find it concerning as an affiliate linking to a third party, that it would claim that it does not endorse it.

- SERVICE SUSPENSION: ProfitTrading APP reserves the right to suspend or cease providing any services relating to the apps published by it, with or without notice, and shall have no liability or responsibility to you in any manner whatsoever if it chooses to do so. The app will only work while the App related exchange API is operative, no refund will be provided if related exchange API is no longer available.

We downloaded both the ProfitTrading app and created a Bittrex account.

Once we have registered with ProfitTrading, we proceeded to Bittrex to create an API key specifically for the purpose of using ProfitTrading. We inputted said keys to the ProfitTrading app and saw our Bittrex balance of 1,500 Bittrex Credits. The API permissions are only set for “Read” and “Trade”. Withdraw permissions are not asked for by the app.

It appears that the real service this “wallet” provides is the ability to coordinate multiple accounts from different cryptocurrency exchanges via bots. A paid copy broker function is also available for a monthly amount.

The verdict of custodial holds as this service is a third party that gives access to other third parties which hold your coins.

Previous Review 2021-09-13

ProfitTrading is a “full Bittrex client.” It offers buying and selling BTC, trading bots, and other features of a trading platform. This usually hints to a custodial nature or a broker.

Increase your profits at Bittrex with Profit Trading! Welcome to the the quickest, easiest and best Bittrex mobile client.

In the description, a BTC wallet is listed as a feature:

A full list of all the currencies in your wallet with their BTC and FIAT equivalences and the total Bitcoin amount. The best place to control your cryptocurrencies.

Verdict: This app is custodial and thus not verifiable.

Product page updated by Daniel Andrei R. Garcia

Do your own research

In addition to reading our analysis, it is important to do your own checks. Before transferring any bitcoin to your wallet, look up reviews for the wallet you want to use. They should be easy to find. If they aren't, that itself is a reason to be extra careful.