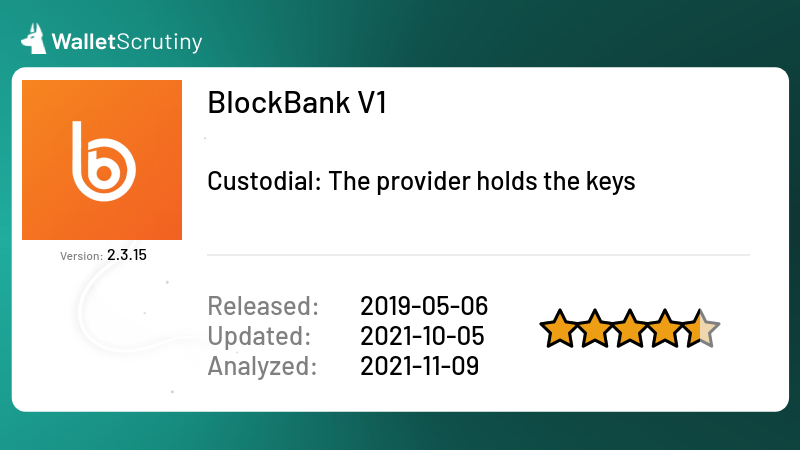

BlockBank V1

App StoreOur wallet review process

We examine wallets starting at the code level and continue all the way up to the finished app that lives on your device. Provided below is an outline of each of these steps along with security tips for you and general test results.

Released

7th May 2019

Custody

Custodial!

But This product was removed from the platform.

As part of our Methodology, we ask: Does the product allow self-custody?

The answer is "no". Therefore we marked it as "Custodial: The provider holds the keys".

Read more

Source code

Application build

Build cannot be done because the source code is not publicly available.Distribution

App StorePassed 5 of 8 tests

We answered the following questions in this order:

We stopped asking questions after we encountered a failed answer.

The answer is "yes".

If the answer were "no", we would mark it as "Fake" and the following would apply:

The answer is "no". We marked it as "Fake".

We did not ask this question because we failed at a previous question.

If the answer were "no", we would mark it as "Fake" and the following would apply:

The bigger wallets often get imitated by scammers that abuse the reputation of the product by imitating its name, logo or both.

Imitating a competitor is a huge red flag and we urge you to not put any money into this product!

The answer is "yes".

If the answer were "no", we would mark it as "Not a wallet" and the following would apply:

The answer is "no". We marked it as "Not a wallet".

We did not ask this question because we failed at a previous question.

If the answer were "no", we would mark it as "Not a wallet" and the following would apply:

If it’s called “wallet” but is actually only a portfolio tracker, we don’t look any deeper, assuming it is not meant to control funds. What has no funds, can’t lose your coins. It might still leak your financial history!

If you can buy Bitcoins with this app but only into another wallet, it’s not a wallet itself.

The answer is "yes".

If the answer were "no", we would mark it as "A wallet but not for Bitcoin" and the following would apply:

The answer is "no". We marked it as "A wallet but not for Bitcoin".

We did not ask this question because we failed at a previous question.

If the answer were "no", we would mark it as "A wallet but not for Bitcoin" and the following would apply:

At this point we only look into wallets that at least also support BTC.

The answer is "yes".

If the answer were "no", we would mark it as "Can't send or receive bitcoins" and the following would apply:

The answer is "no". We marked it as "Can't send or receive bitcoins".

We did not ask this question because we failed at a previous question.

If the answer were "no", we would mark it as "Can't send or receive bitcoins" and the following would apply:

If it is for holding BTC but you can’t actually send or receive them with this product then it doesn’t function like a wallet for BTC but you might still be using it to hold your bitcoins with the intention to convert back to fiat when you “cash out”.

All products in this category are custodial and thus funds are at the mercy of the provider.

The product cannot be independently verified. If the provider puts your funds at risk on purpose or by accident, you will probably not know about the issue before people start losing money. If the provider is more criminally inclined he might have collected all the backups of all the wallets, ready to be emptied at the press of a button. The product might have a formidable track record but out of distress or change in management turns out to be evil from some point on, with nobody outside ever knowing before it is too late.

The answer is "yes".

If the answer were "no", we would mark it as "Custodial: The provider holds the keys" and the following would apply:

The answer is "no". We marked it as "Custodial: The provider holds the keys".

We did not ask this question because we failed at a previous question.

If the answer were "no", we would mark it as "Custodial: The provider holds the keys" and the following would apply:

A custodial service is a service where the funds are held by a third party like the provider. The custodial service can at any point steal all the funds of all the users at their discretion. Our investigations stop there.

Some services might claim their setup is super secure, that they don’t actually have access to the funds, or that the access is shared between multiple parties. For our evaluation of it being a wallet, these details are irrelevant. They might be a trustworthy Bitcoin bank and they might be a better fit for certain users than being your own bank but our investigation still stops there as we are only interested in wallets.

Products that claim to be non-custodial but feature custodial accounts without very clearly marking those as custodial are also considered “custodial” as a whole to avoid misguiding users that follow our assessment.

We have to acknowledge that a huge majority of Bitcoiners are currently using custodial Bitcoin banks. If you do, please:

- Do your own research if the provider is trust-worthy!

- Check if you know at least enough about them so you can sue them when you have to!

- Check if the provider is under a jurisdiction that will allow them to release your funds when you need them?

- Check if the provider is taking security measures proportional to the amount of funds secured? If they have a million users and don’t use cold storage, that hot wallet is a million times more valuable for hackers to attack. A million times more effort will be taken by hackers to infiltrate their security systems.

The answer is "yes".

If the answer were "no", we would mark it as "No source for current release found" and the following would apply:

The answer is "no". We marked it as "No source for current release found".

We did not ask this question because we failed at a previous question.

If the answer were "no", we would mark it as "No source for current release found" and the following would apply:

A wallet that claims to not give the provider the means to steal the users’ funds might actually be lying. In the spirit of “Don’t trust - verify!” you don’t want to take the provider at his word, but trust that people hunting for fame and bug bounties could actually find flaws and back-doors in the wallet so the provider doesn’t dare to put these in.

Back-doors and flaws are frequently found in closed source products but some remain hidden for years. And even in open source security software there might be catastrophic flaws undiscovered for years.

An evil wallet provider would certainly prefer not to publish the code, as hiding it makes audits orders of magnitude harder.

For your security, you thus want the code to be available for review.

If the wallet provider doesn’t share up to date code, our analysis stops there as the wallet could steal your funds at any time, and there is no protection except the provider’s word.

“Up to date” strictly means that any instance of the product being updated without the source code being updated counts as closed source. This puts the burden on the provider to always first release the source code before releasing the product’s update. This paragraph is a clarification to our rules following a little poll.

We are not concerned about the license as long as it allows us to perform our analysis. For a security audit, it is not necessary that the provider allows others to use their code for a competing wallet. You should still prefer actual open source licenses as a competing wallet won’t use the code without giving it careful scrutiny.

The product cannot be independently verified. If the provider puts your funds at risk on purpose or by accident, you will probably not know about the issue before people start losing money. If the provider is more criminally inclined he might have collected all the backups of all the wallets, ready to be emptied at the press of a button. The product might have a formidable track record but out of distress or change in management turns out to be evil from some point on, with nobody outside ever knowing before it is too late.Application information

Update 2021-11-03: This app is no more.

(Analysis from Android review)

Updated Review 2023-04-05

There are currently 4 blockbank apps on WalletScrutiny and still available on Google Play and iOS.

Version 1 includes:

BlockBank V1

(This one)

BlockBank V1

(This one) BlockBank V1

BlockBank V1

Version 2 includes:

This is addressed in the FAQ, with the following information on how to migrate V1 to V2:

Update 2021-11-03: This app is no more.

Google Play

Self described:

BlockBank is a non-custodial utility wallet that combines the power of decentralized and centralized technology.

Buy Crypto: A simple, secure and fast way to buy Bitcoin and crypto.

Keep your private key secure: with simple features like PIN lock, fingerprint recognition, wallet backup and email verification.

The app has many other features related to DeFi and staking.

The Site

Barely two minutes into Blockbank’s site, we were contacted by support through the embedded chat’s browser notification. We engaged with a conversation with them and they asserted that V2 will be non-custodial. We then asked for links to their source code if it was open source. They replied that they’d have to consult their developers for that. We were able to locate their github page, but it was not directly linked from their site.

Terms of Use

Many provisions in Blockbank’s Terms seem to point to a custodial service.

Termination related clauses, under Section 4:

We reserve the right to suspend, restrict or terminate your access to any or all of our Services and to deactivate your account, including without limitation

Furthermore:

In the event that we decide to suspend, restrict or terminate your access to our Services in accordance with the provisions of this Clause 2, we will (to the extent that it is not unlawful for us to do so) provide you with adequate notice of such termination of Services. Suspensions from the use of our Services will be reversed only as soon as reasonably practicable once the reasons for refusal no longer exist. We are under no obligation to execute any suspended, reversed or terminated transactions at the same price or on the same terms.

We do not guarantee that any specific content, component and/or feature will always be available on the BlockBank.ai Wallet App Services.

Concerning the App’s Functions:

The BlockBank.ai Application gives you interactive access to your Digital multi protocol Asset Wallet, including allowing you to perform one or more of the following actions:

(a) view the balance and Transaction History of your Digital Asset Wallet;

(b) send and receive digital assets within the app.

View the market cap of the top 100 tokens;

(c) access news in one location;

(d) view the market cap of the top 100 tokens.

Concerning Open Source

We may make (but are not obligated to make) the source code for the software we develop available for download as open source software. You agree to be bound by, and comply with, any license agreement that applies to this open source software. You will not indicate that you are associated with us in connection with your use, modifications or distributions of this open source software.

Blockbank’s “Lightpaper”

Blockbank has a lightpaper which can be accessed here.

BlockBank consists of 4 main components:

- a centralized custodial wallet,

- a non-custodial web 3 wallet,

- complete banking tech stack service,

- banking and true AI (Robo Advisory).

The App

We tried the Blockbank app. Upon installation, we were greeted by this message:

Welcome to blockBank

BlockBank is a multi-protocol utility wallet that combines the power of decentralized and centralized technology in a simple and secure application.

BlockBank’s vision is to create an all-in-one crypto application that simplifies the user experience without compromising security, privacy, or decentralization. We aim to combine the best of Defi and DeFi worlds in one place, incorporating AI technology to bring financial empowerment to clients.

Blockbank has the user private keys encrypted with a pin code and secured through biometrics.

Registration

- Username

- Email (Needed in case user forgets pin)

- Pin

- First Name

- Last Name

- Phone (for sms verification)

The next step is to backup the wallet accessible via the pin. Encryption used is AES 256-bit. Password for backup file. The backup is stored in a txt file locally.

Tapping on ‘Settings’ opens a menu with the following sub-menus:

- Backup

- Restore

- Private Keys

Selecting ‘Private Keys’ opens a menu with a gallery of 12 coins. Bitcoin is included. Selecting Bitcoin opens a prompt for the Pin. Inputting the Pin gives access to the private key. We tried importing the Blockbank private key to a third-party bitcoin wallet and we’ve managed to create a “watching-only wallet”

Contact

We reached out to Blockbank via their onpage chat support.

Verdict

This was a difficult app to review and we would be open to correction and/or clarification, particularly if Blockbank would reply to our queries. On one hand, the app claims to be non-custodial, and provides the user with the private key, the ability to backup and restore the wallet. However, importing the private key to another wallet, we were only able to create a “watching only” wallet. Furthermore, the Blockbank wallet app backup can only be used with another Blockbank wallet app. Now this becomes problematic especially since it is stated in the terms of use that:

We do not guarantee that any specific content, component and/or feature will always be available on the BlockBank.ai Wallet App Services

This clause falls under termination. You may have the backup or the private key, but if you don’t have access to the app - because let’s say, your account was suspended, then this is a custodial service and therefore not verifiable

Note: With that said, we are willing to change our verdict upon further guidance by the Blockbank team.

Tests performed by Daniel Andrei R. Garcia

Do your own research

In addition to reading our analysis, it is important to do your own checks. Before transferring any bitcoin to your wallet, look up reviews for the wallet you want to use. They should be easy to find. If they aren't, that itself is a reason to be extra careful.