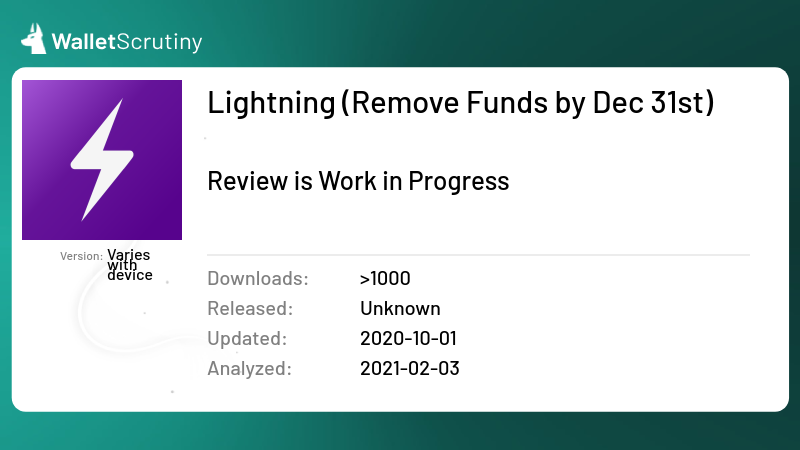

Lightning (Remove Funds by Dec 31st)

Google PlayOur wallet review process

We examine wallets starting at the code level and continue all the way up to the finished app that lives on your device. Provided below is an outline of each of these steps along with security tips for you and general test results.

Custody

Work In Progress

Also This product was removed from the platform.

As part of our Methodology, we ask: Is the product self-custodial?

However, we did not run this test because we failed at a preceding test.

Read more

Released

We could not determine when this product was originally released.

Application build

We still have to analyze this product.

See the last Issue we created.

Passed 0 of 10 tests

We answered the following questions in this order:

We did not yet perform any tests.

The answer is "yes".

If the answer was "no", we would mark it as "Few users" and the following would apply:

The answer is "no". We marked it as "Few users".

We did not ask this question because we failed at a previous question.

If the answer was "no", we would mark it as "Few users" and the following would apply:

We focus on products that have the biggest impact if things go wrong and this one probably doesn’t have many users according to data publicly available.

The answer is "yes".

If the answer was "no", we would mark it as "Fake" and the following would apply:

The answer is "no". We marked it as "Fake".

We did not ask this question because we failed at a previous question.

If the answer was "no", we would mark it as "Fake" and the following would apply:

The bigger wallets often get imitated by scammers that abuse the reputation of the product by imitating its name, logo or both.

Imitating a competitor is a huge red flag and we urge you to not put any money into this product!

The answer is "yes".

If the answer was "no", we would mark it as "Not a wallet" and the following would apply:

The answer is "no". We marked it as "Not a wallet".

We did not ask this question because we failed at a previous question.

If the answer was "no", we would mark it as "Not a wallet" and the following would apply:

If it’s called “wallet” but is actually only a portfolio tracker, we don’t look any deeper, assuming it is not meant to control funds. What has no funds, can’t lose your coins. It might still leak your financial history!

If you can buy Bitcoins with this app but only into another wallet, it’s not a wallet itself.

The answer is "yes".

If the answer was "no", we would mark it as "A wallet but not for Bitcoin" and the following would apply:

The answer is "no". We marked it as "A wallet but not for Bitcoin".

We did not ask this question because we failed at a previous question.

If the answer was "no", we would mark it as "A wallet but not for Bitcoin" and the following would apply:

At this point we only look into wallets that at least also support BTC.

The answer is "yes".

If the answer was "no", we would mark it as "Can't send or receive bitcoins" and the following would apply:

The answer is "no". We marked it as "Can't send or receive bitcoins".

We did not ask this question because we failed at a previous question.

If the answer was "no", we would mark it as "Can't send or receive bitcoins" and the following would apply:

If it is for holding BTC but you can’t actually send or receive them with this product then it doesn’t function like a wallet for BTC but you might still be using it to hold your bitcoins with the intention to convert back to fiat when you “cash out”.

All products in this category are custodial and thus funds are at the mercy of the provider.

The product cannot be independently verified. If the provider puts your funds at risk on purpose or by accident, you will probably not know about the issue before people start losing money. If the provider is more criminally inclined he might have collected all the backups of all the wallets, ready to be emptied at the press of a button. The product might have a formidable track record but out of distress or change in management turns out to be evil from some point on, with nobody outside ever knowing before it is too late.The answer is "yes".

If the answer was "no", we would mark it as "Custodial: The provider holds the keys" and the following would apply:

The answer is "no". We marked it as "Custodial: The provider holds the keys".

We did not ask this question because we failed at a previous question.

If the answer was "no", we would mark it as "Custodial: The provider holds the keys" and the following would apply:

A custodial service is a service where the funds are held by a third party like the provider. The custodial service can at any point steal all the funds of all the users at their discretion. Our investigations stop there.

Some services might claim their setup is super secure, that they don’t actually have access to the funds, or that the access is shared between multiple parties. For our evaluation of it being a wallet, these details are irrelevant. They might be a trustworthy Bitcoin bank and they might be a better fit for certain users than being your own bank but our investigation still stops there as we are only interested in wallets.

Products that claim to be non-custodial but feature custodial accounts without very clearly marking those as custodial are also considered “custodial” as a whole to avoid misguiding users that follow our assessment.

This verdict means that the provider might or might not publish source code and maybe it is even possible to reproduce the build from the source code but as it is custodial, the provider already has control over the funds, so it is not a wallet where you would be in exclusive control of your funds.

We have to acknowledge that a huge majority of Bitcoiners are currently using custodial Bitcoin banks. If you do, please:

- Do your own research if the provider is trust-worthy!

- Check if you know at least enough about them so you can sue them when you have to!

- Check if the provider is under a jurisdiction that will allow them to release your funds when you need them?

- Check if the provider is taking security measures proportional to the amount of funds secured? If they have a million users and don’t use cold storage, that hot wallet is a million times more valuable for hackers to attack. A million times more effort will be taken by hackers to infiltrate their security systems.

The answer is "yes".

If the answer was "no", we would mark it as "No source for current release found" and the following would apply:

The answer is "no". We marked it as "No source for current release found".

We did not ask this question because we failed at a previous question.

If the answer was "no", we would mark it as "No source for current release found" and the following would apply:

A wallet that claims to not give the provider the means to steal the users’ funds might actually be lying. In the spirit of “Don’t trust - verify!” you don’t want to take the provider at his word, but trust that people hunting for fame and bug bounties could actually find flaws and back-doors in the wallet so the provider doesn’t dare to put these in.

Back-doors and flaws are frequently found in closed source products but some remain hidden for years. And even in open source security software there might be catastrophic flaws undiscovered for years.

An evil wallet provider would certainly prefer not to publish the code, as hiding it makes audits orders of magnitude harder.

For your security, you thus want the code to be available for review.

If the wallet provider doesn’t share up to date code, our analysis stops there as the wallet could steal your funds at any time, and there is no protection except the provider’s word.

“Up to date” strictly means that any instance of the product being updated without the source code being updated counts as closed source. This puts the burden on the provider to always first release the source code before releasing the product’s update. This paragraph is a clarification to our rules following a little poll.

We are not concerned about the license as long as it allows us to perform our analysis. For a security audit, it is not necessary that the provider allows others to use their code for a competing wallet. You should still prefer actual open source licenses as a competing wallet won’t use the code without giving it careful scrutiny.

The product cannot be independently verified. If the provider puts your funds at risk on purpose or by accident, you will probably not know about the issue before people start losing money. If the provider is more criminally inclined he might have collected all the backups of all the wallets, ready to be emptied at the press of a button. The product might have a formidable track record but out of distress or change in management turns out to be evil from some point on, with nobody outside ever knowing before it is too late.The answer is "yes".

If the answer was "no", we would mark it as "Failed to build from source provided!" and the following would apply:

The answer is "no". We marked it as "Failed to build from source provided!".

We did not ask this question because we failed at a previous question.

If the answer was "no", we would mark it as "Failed to build from source provided!" and the following would apply:

Published code doesn’t help much if the app fails to compile.

We try to compile the published source code using the published build instructions into a binary. If that fails, we might try to work around issues but if we consistently fail to build the app, we give it this verdict and open an issue in the issue tracker of the provider to hopefully verify their app later.

The product cannot be independently verified. If the provider puts your funds at risk on purpose or by accident, you will probably not know about the issue before people start losing money. If the provider is more criminally inclined he might have collected all the backups of all the wallets, ready to be emptied at the press of a button. The product might have a formidable track record but out of distress or change in management turns out to be evil from some point on, with nobody outside ever knowing before it is too late.The answer is "yes".

If the answer was "no", we would mark it as "Not reproducible from source provided" and the following would apply:

The answer is "no". We marked it as "Not reproducible from source provided".

We did not ask this question because we failed at a previous question.

If the answer was "no", we would mark it as "Not reproducible from source provided" and the following would apply:

Published code doesn’t help much if it is not what the published binary was built from. That is why we try to reproduce the binary. We

- obtain the binary from the provider

- compile the published source code using the published build instructions into a binary

- compare the two binaries

- we might spend some time working around issues that are easy to work around

If this fails, we might search if other revisions match or if we can deduct the source of the mismatch but generally consider it on the provider to provide the correct source code and build instructions to reproduce the build, so we usually open a ticket in their code repository.

In any case, the result is a discrepancy between the binary we can create and the binary we can find for download and any discrepancy might leak your backup to the server on purpose or by accident.

As we cannot verify that the source provided is the source the binary was compiled from, this category is only slightly better than closed source but for now we have hope projects come around and fix verifiability issues.

The product cannot be independently verified. If the provider puts your funds at risk on purpose or by accident, you will probably not know about the issue before people start losing money. If the provider is more criminally inclined he might have collected all the backups of all the wallets, ready to be emptied at the press of a button. The product might have a formidable track record but out of distress or change in management turns out to be evil from some point on, with nobody outside ever knowing before it is too late.Application build test result

Update: This app is not supported by its provider anymore. As the name reads “Lightning (Remove Funds by Dec 31st)” and the description talks about “3 months” we assume this app still being on Google Play is an accident.

From the description:

- Install the app and follow the setup instructions.

- Send a small amount of BTC to your wallet address (not more than you are willing to lose, it’s alpha)

- Wait a few minutes for the wallet to sync. Once completed, the app will open payment channels automatically. The funding transactions need to confirm just like regular on-chain transactions.

If it “sync”s and “open payment channels automatically”, it is probably a non-custodial app, although that is not said explicitly in the description.

But there is also a link to their GitHub.

There is no word on the Android build on the main Readme.md but under mobile we find something …

$ git clone https://github.com/lightninglabs/lightning-app

$ cd lightning-app/

$ docker run --rm --volume=$PWD:/mnt --workdir=/mnt -it beevelop/cordova bash

root@bf7373350a59:/mnt# npm install

...

added 2140 packages from 1995 contributors and audited 943144 packages in 68.29s

found 11 vulnerabilities (8 moderate, 3 high)

run `npm audit fix` to fix them, or `npm audit` for details

root@bf7373350a59:/mnt# cd mobile

root@bf7373350a59:/mnt/mobile# npm install

root@bf7373350a59:/mnt/mobile# cd android/

root@bf7373350a59:/mnt/mobile/android# yes | /opt/android/tools/bin/sdkmanager "build-tools;28.0.3"

root@bf7373350a59:/mnt/mobile/android# ./gradlew bundleRelease

> Task :app:bundleReleaseJsAndAssets

warning: the transform cache was reset.

Loading dependency graph, done.

error Unable to resolve module `../../assets/rpc` from `/mnt/src/action/grpc-mobile.js`: The module `../../assets/rpc` could not be found from `/mnt/src/action/grpc-mobile.js`. Indeed, none of these files exist:

* `/mnt/assets/rpc(.native||.android.js|.native.js|.js|.android.json|.native.json|.json|.android.ts|.native.ts|.ts|.android.tsx|.native.tsx|.tsx)`

* `/mnt/assets/rpc/index(.native||.android.js|.native.js|.js|.android.json|.native.json|.json|.android.ts|.native.ts|.ts|.android.tsx|.native.tsx|.tsx)`. Run CLI with --verbose flag for more details.

> Task :app:bundleReleaseJsAndAssets FAILED

FAILURE: Build failed with an exception.

* What went wrong:

Execution failed for task ':app:bundleReleaseJsAndAssets'.

> Process 'command 'node'' finished with non-zero exit value 1

* Try:

Run with --stacktrace option to get the stack trace. Run with --info or --debug option to get more log output. Run with --scan to get full insights.

* Get more help at https://help.gradle.org

Deprecated Gradle features were used in this build, making it incompatible with Gradle 5.0.

Use '--warning-mode all' to show the individual deprecation warnings.

See https://docs.gradle.org/4.10.1/userguide/command_line_interface.html#sec:command_line_warnings

BUILD FAILED in 30s

1 actionable task: 1 executed

So we threw what we know at it but failed there.

We did not take the route using Android Studio, as that should never be necessary as Android Studio itself uses gradle to build Android projects. For our purpose a tool with graphical interface, involving clicking buttons is not practical as build verification will be fully automated as it needs to be reevaluated after each release.

So for now we hope for better build instructions so we can soon give it another try and conclude this provider probably shares the source but it’s not verifiable.

Do your own research

In addition to reading our analysis, it is important to do your own checks. Before transferring any bitcoin to your wallet, look up reviews for the wallet you want to use. They should be easy to find. If they aren't, that itself is a reason to be extra careful.