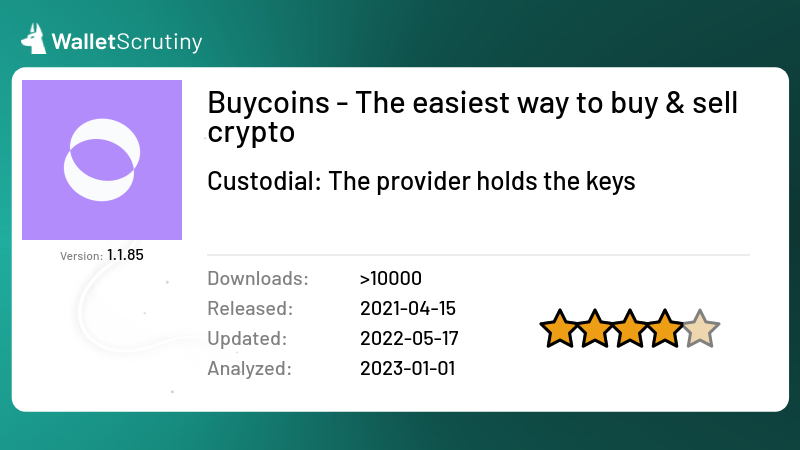

Buycoins - The easiest way to buy & sell crypto

Google PlayOur wallet review process

We examine wallets starting at the code level and continue all the way up to the finished app that lives on your device. Provided below is an outline of each of these steps along with security tips for you and general test results.

Released

16th April 2021

Custody

Custodial!

But This product was removed from the platform.

As part of our Methodology, we ask: Is the product self-custodial?

The answer is "no". Therefore we marked it as "Custodial: The provider holds the keys".

Read more

Source code

Application build

Build cannot be done because the source code is not publicly available.Passed 5 of 8 tests

We answered the following questions in this order:

We stopped asking questions after we encountered a failed answer.

The answer is "yes".

If the answer was "no", we would mark it as "Few users" and the following would apply:

The answer is "no". We marked it as "Few users".

We did not ask this question because we failed at a previous question.

If the answer was "no", we would mark it as "Few users" and the following would apply:

We focus on products that have the biggest impact if things go wrong and this one probably doesn’t have many users according to data publicly available.

The answer is "yes".

If the answer was "no", we would mark it as "Fake" and the following would apply:

The answer is "no". We marked it as "Fake".

We did not ask this question because we failed at a previous question.

If the answer was "no", we would mark it as "Fake" and the following would apply:

The bigger wallets often get imitated by scammers that abuse the reputation of the product by imitating its name, logo or both.

Imitating a competitor is a huge red flag and we urge you to not put any money into this product!

The answer is "yes".

If the answer was "no", we would mark it as "Not a wallet" and the following would apply:

The answer is "no". We marked it as "Not a wallet".

We did not ask this question because we failed at a previous question.

If the answer was "no", we would mark it as "Not a wallet" and the following would apply:

If it’s called “wallet” but is actually only a portfolio tracker, we don’t look any deeper, assuming it is not meant to control funds. What has no funds, can’t lose your coins. It might still leak your financial history!

If you can buy Bitcoins with this app but only into another wallet, it’s not a wallet itself.

The answer is "yes".

If the answer was "no", we would mark it as "A wallet but not for Bitcoin" and the following would apply:

The answer is "no". We marked it as "A wallet but not for Bitcoin".

We did not ask this question because we failed at a previous question.

If the answer was "no", we would mark it as "A wallet but not for Bitcoin" and the following would apply:

At this point we only look into wallets that at least also support BTC.

The answer is "yes".

If the answer was "no", we would mark it as "Can't send or receive bitcoins" and the following would apply:

The answer is "no". We marked it as "Can't send or receive bitcoins".

We did not ask this question because we failed at a previous question.

If the answer was "no", we would mark it as "Can't send or receive bitcoins" and the following would apply:

If it is for holding BTC but you can’t actually send or receive them with this product then it doesn’t function like a wallet for BTC but you might still be using it to hold your bitcoins with the intention to convert back to fiat when you “cash out”.

All products in this category are custodial and thus funds are at the mercy of the provider.

The product cannot be independently verified. If the provider puts your funds at risk on purpose or by accident, you will probably not know about the issue before people start losing money. If the provider is more criminally inclined he might have collected all the backups of all the wallets, ready to be emptied at the press of a button. The product might have a formidable track record but out of distress or change in management turns out to be evil from some point on, with nobody outside ever knowing before it is too late.The answer is "yes".

If the answer was "no", we would mark it as "Custodial: The provider holds the keys" and the following would apply:

The answer is "no". We marked it as "Custodial: The provider holds the keys".

We did not ask this question because we failed at a previous question.

If the answer was "no", we would mark it as "Custodial: The provider holds the keys" and the following would apply:

A custodial service is a service where the funds are held by a third party like the provider. The custodial service can at any point steal all the funds of all the users at their discretion. Our investigations stop there.

Some services might claim their setup is super secure, that they don’t actually have access to the funds, or that the access is shared between multiple parties. For our evaluation of it being a wallet, these details are irrelevant. They might be a trustworthy Bitcoin bank and they might be a better fit for certain users than being your own bank but our investigation still stops there as we are only interested in wallets.

Products that claim to be non-custodial but feature custodial accounts without very clearly marking those as custodial are also considered “custodial” as a whole to avoid misguiding users that follow our assessment.

This verdict means that the provider might or might not publish source code and maybe it is even possible to reproduce the build from the source code but as it is custodial, the provider already has control over the funds, so it is not a wallet where you would be in exclusive control of your funds.

We have to acknowledge that a huge majority of Bitcoiners are currently using custodial Bitcoin banks. If you do, please:

- Do your own research if the provider is trust-worthy!

- Check if you know at least enough about them so you can sue them when you have to!

- Check if the provider is under a jurisdiction that will allow them to release your funds when you need them?

- Check if the provider is taking security measures proportional to the amount of funds secured? If they have a million users and don’t use cold storage, that hot wallet is a million times more valuable for hackers to attack. A million times more effort will be taken by hackers to infiltrate their security systems.

The answer is "yes".

If the answer was "no", we would mark it as "No source for current release found" and the following would apply:

The answer is "no". We marked it as "No source for current release found".

We did not ask this question because we failed at a previous question.

If the answer was "no", we would mark it as "No source for current release found" and the following would apply:

A wallet that claims to not give the provider the means to steal the users’ funds might actually be lying. In the spirit of “Don’t trust - verify!” you don’t want to take the provider at his word, but trust that people hunting for fame and bug bounties could actually find flaws and back-doors in the wallet so the provider doesn’t dare to put these in.

Back-doors and flaws are frequently found in closed source products but some remain hidden for years. And even in open source security software there might be catastrophic flaws undiscovered for years.

An evil wallet provider would certainly prefer not to publish the code, as hiding it makes audits orders of magnitude harder.

For your security, you thus want the code to be available for review.

If the wallet provider doesn’t share up to date code, our analysis stops there as the wallet could steal your funds at any time, and there is no protection except the provider’s word.

“Up to date” strictly means that any instance of the product being updated without the source code being updated counts as closed source. This puts the burden on the provider to always first release the source code before releasing the product’s update. This paragraph is a clarification to our rules following a little poll.

We are not concerned about the license as long as it allows us to perform our analysis. For a security audit, it is not necessary that the provider allows others to use their code for a competing wallet. You should still prefer actual open source licenses as a competing wallet won’t use the code without giving it careful scrutiny.

The product cannot be independently verified. If the provider puts your funds at risk on purpose or by accident, you will probably not know about the issue before people start losing money. If the provider is more criminally inclined he might have collected all the backups of all the wallets, ready to be emptied at the press of a button. The product might have a formidable track record but out of distress or change in management turns out to be evil from some point on, with nobody outside ever knowing before it is too late.Application build test result

Update 2021-10-08

We noticed that there were 2 other apps with similar logos and similar sounding names:

Number 1, has been found to have some red flags according to the previous reviewer. We tried to access Google Play’s ratings for that app, but that app’s page is no longer available.

We have yet to review BuyCoins Pro.

Google Play Critical Reviews

Naphtali Noah

★☆☆☆☆ August 17, 2021

My first time using this app and its giving me tough time. I couldn’t log in cause its showing wrong password and later on locked the app for 6 hours. This is horrible

abiola okubanjo

★☆☆☆☆ May 6, 2021

Let’s go back to the old app, this new app is annoying, nothing is working, no p2p, can’t deposit, can’t withdraw, can’t buy and sell coin. Why bring an update that is not not working?

Company/Developer Profile

Developer/Company: Crunchbase Profile - Bitkoin Africa Inc.

CEO: Crunchbase Profile: Timi Ajiboye

According to a pinned tweet dated October 1, 2021:

Today, @buycoins turns 4. Today, we become Helicarrier.

The Medium post referenced by the tweet can be found here.

Some quotes:

We’ve gone from a website for P2P Bitcoin trading to building:

- Buycoins — The easiest way to buy, sell and store cryptocurrencies in Africa.

- Buycoins Pro — Orderbook for advanced digital asset trading.

- Sendcash — Crypto powered remittance.

- Sendcash Pay — A suite of developer tools that let you add borderless payment experiences to your digital products.

- NGNT — A collateral-backed digital currency that bridges the Naira with the advantages of decentralized blockchain technology.

It is noteworthy that despite the critical reviews, the developer has constantly responded to the criticism in a professional manner. while there may be problems with the app, for now, we believe it is more prudent to assess these problems due to faulty implementation.

With that said, we advise potential users to take the necessary precautions.

App Description

The features are described:

- Send and receive cryptocurrencies easily

- Zero transaction fees

- Fast payments

- Secure wallet

- Buy cryptocurrencies - Fund your account with Naira and easily buy Bitcoin, Ethereum, USDT and other cryptocurrencies.

- Instantly sell your coins and withdraw your money to your bank account.

The Site

Terms of Service

The Terms specify the site’s power to freeze the assets of the user in section 5.4,

We reserve the right to cancel and/or suspend your Buycoins Account and/or block transactions or freeze funds immediately and without notice if we determine, in our sole discretion, that your Account is associated with a Prohibited Use and/or a Prohibited Business.

The App

We downloaded the app and tried to register. We were unable to register because the OTP (One-Time Password) did not arrive.

Verdict

Despite our inability to register both on the app and on the web platform, we have sufficient reason to believe that this app is custodial due to their ability to cancel the accounts and freeze the funds of users. Any app that has the ability to do this in their own sole discretion makes it custodial and therefore not verifiable.

Tests performed by Daniel Andrei R. Garcia

Do your own research

In addition to reading our analysis, it is important to do your own checks. Before transferring any bitcoin to your wallet, look up reviews for the wallet you want to use. They should be easy to find. If they aren't, that itself is a reason to be extra careful.